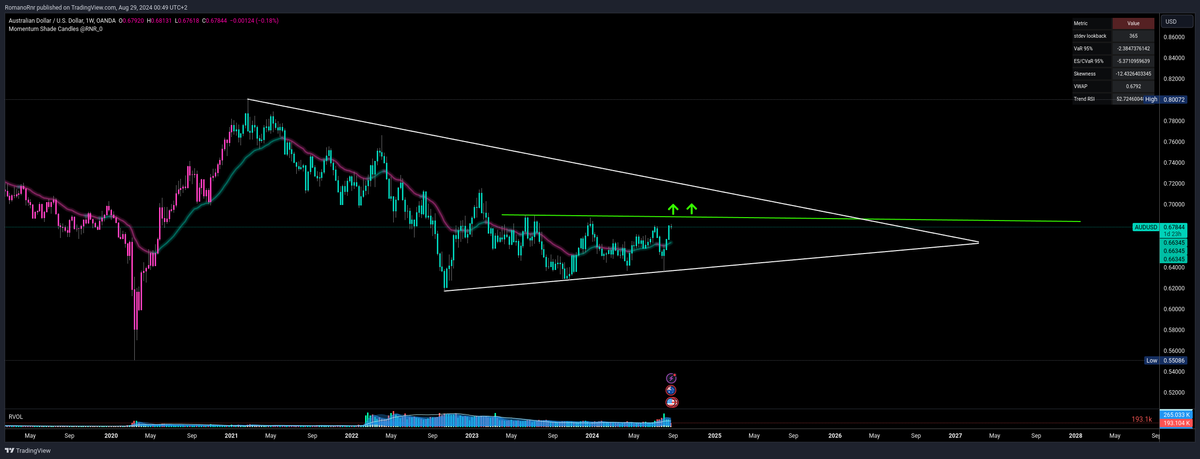

The Australian Dollar - Iron Ore and China

The Australian Dollar seems to be edging higher over the next few quarters. By the end of 2024, we could see AUD/USD hovering around 0.69 and perhaps 0.72 somewhere, most likely late in 2025.

But it will be a long road that takes time. One of the biggest problems is the lack of demand for Australia's iron ore, driven by weak global markets that continue to weigh down on the Australian dollar.

The slow grind-up in AUD has a lot to do with the U.S. As interest rates between the two economies converge, AUD/USD is finding some support. The Reserve Bank of Australia (RBA) has taken on a more hawkish tone since its August meeting, signaling they're not in a rush to cut interest rates, and that's for good reasons. Australia's job market is strong, while inflation is still running hotter than the RBA would like.

Despite the positive factors boosting the AUD, it's unlikely for now that the AUD/USD will surpass the 0.70 mark unless there are changes in China. China's economy, which is important for Australian exports such as iron ore, is currently going through a downturn. Indicators such as new home sales and credit growth present a grim outlook, and unless there's an improvement in China, the AUD's price increase may be limited.

Here is where it gets interesting. Sentiment around China is already so negative that any further drop isn't likely to drag AUD much lower.

Article does not end here. Just an update about the previous calls

Yes, been a while since I wrote. The Older newsletter published can be found here

July 18th: https://www.romanornr.io/global-equity-newsletter-the-neoliberal-era-killshot-18-07-2024/

Results: You may remember this one I posted on July 18th before the collapse of stocks on August 5th

August 7th: https://www.romanornr.io/the-largest-carry-trade-unwind-the-world-has-ever-rewind/

I am pleased to see how almost everything worked out. Been doing great too with stocks. Also started selling my tech stocks on August 22, 23, and 24

800k downward revision

— Romano (@RNR_0) August 22, 2024

SPX500 & Nasdaq rally being a trap

Some people are gonna be stuck in a pain trade

Nobody wants to sell the top

They wanna sell when they have to https://t.co/4UZvGUsFTT

To continue

The upside probability includes a depreciation of the US dollar and differences in interest rates. If the dollar weakens, the Australian dollar can be stronger than the dollar (relatively), as in the pair AUD/USD.

The other big reason AUD has a lot of upside potential is that if Australia's interest rates are higher than other countries, investors might prefer to hold AUD for better returns.

Because Australia's interest rates are expected to stay higher for longer than those of other major economies, the AUD is likely to gain value against other major currencies in the G10 by the end of the year.

China headwind

China is still affecting the Australian dollar. While the Australian Dollar has become less sensitive to China (apart from the impact of the USD), it still affects the AUD/USD exchange rate. A recovery in China's new home sales is crucial for the growth of property-driven commodity imports from Australia.

Despite several property easing measures in 2024, new home sales are still significantly lower, and home prices have dropped for the 14th consecutive month. The Australian dollar is more closely connected to metal prices than other commodity currencies such as the Canadian dollar (CAD) and the New Zealand dollar (NZD). Iron ore prices have decreased by over 30% year-to-date, and the deteriorating Chinese property market continues to reduce demand for iron ore due to the decline in steel production in China.

Weak credit growth in China may lead to lower import demand. China's credit impulse, which usually precedes import growth from Australia, shows a sluggish outlook. This negative view of China's commodity demand is expected to limit the upside for the AUD. China's sentiment measure remains at a historical bearish level. However, it's unlikely to cause a sharp fall either, as the sentiment reflects that bad news is potentially well-priced.

Also, if you are a premium member, join Discord for full benefits.

Yes, options data, such as dark pools, options gamma, unusual flow, etc., are also included.

The article does not end here; scroll down to continue reading

Super fund flows

Australian retirement funds, known as superannuation funds, may help support the Australian dollar by increasing their hedge ratios on current assets. This hasn't happened yet, but it could be a possibility in the long term if the US dollar keeps falling. There are already signs that investors in other countries are starting to raise their hedge ratios.

In Australia, the low hedge ratios on international equity holdings are due to factors other than hedge costs. Asset allocators have kept these hedge ratios low because of the AUD's sensitivity to global risk factors.

These industry super funds have increased their hedged assets mainly due to shifts in asset allocation, moving into more defensive asset classes like fixed income, infrastructure, and property, which usually have a higher hedge ratio.

Also, an important read if you don't know why property have higher hedge ratios: https://medium.com/@romanornr/bitmex-quanto-linear-inverse-futures-contracts-0c553280324c

Cumulative year-to-date FX return by time zone

AUD/USD moved within a narrow range this year, with the current price still below its beginning point. The Australian Dollar's underperformance mainly comes from selling pressure during European trading hours.

US and Asian investors have shown a more neutral stance towards the Australian Dollar this year. Most of the Australian Dollar's losses happened during European trading hours, leading to a cumulative return of -2.8%. This negative performance during European hours contrasts with the positive cumulative return of the EUR/USD pair during the same period.

With the expectation that the dollar might start to weaken again, AUD/USD, which has lagged behind European trading hours, has a potential for a rally.

I will try to buy/long AUDUSD; it's a contrarian trade. AUD/USD realized volatility has bounced back quickly after hitting a low of 6.5 vol (which is in the bottom of the 5th percentile of the past 10 years) at the end of July.

I favor OTM call options. The difference in implied volatility between short-term AUD puts, and calls (risk reversal) has widened sharply.

So yes, the implied volatility for short-term puts has seen increased demand. The market is more worried about the AUD falling, perhaps a bit too worried. When everyone is hedged to the teeth, markets usually don't fall much, as it creates a synthetic floor in the market.

Discord link?

In the previous article I mentioned: "Currently, I am not accepting new Discord members. There are some problems with Ghost blog new API. I created a Discord bot but their new API changes made most API calls obsolete and the way of creating private calls with JWT tokens"

I believe this problem is resolved, signups for the newsletter and Discord are open again. Sign-ups will be temporarily closed if too many people sign up all at once. New members need to digest information and trading style. Also the community helping out.

Also, if you are a premium member, join Discord for full benefits.

Yes, options data, such as dark pools, options gamma, unusual flow, etc., are also included.

The article does not end here; scroll down to continue reading

2 articles ago I also covered charts: https://www.romanornr.io/global-equity-newsletter-the-neoliberal-era-killshot-18-07-2024/

result, AUDCAD went down 3.59%

The result, EURUSD was down 1.36% (but recovered days later)

Also covered QQQ

Well, that collapsed entirely during the August 5th crash