Strategize: Prepare For A Last Rate Hike & Market Crash

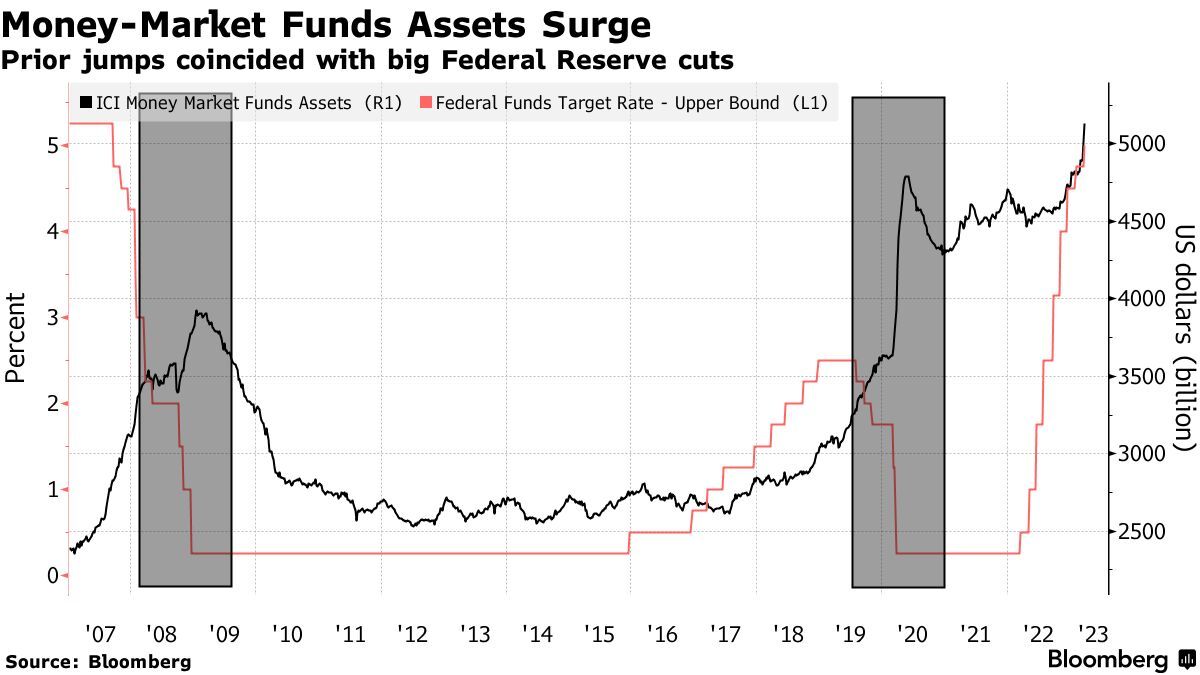

The current hiking cycle started in 2022, and the Federal Reserve raised interest rates to unprecedented levels, putting immense pressure on the balance sheets of many banks, especially those relying on regional lending.

As their bond portfolio deteriorates, they will face insolvency & most likely default on their obligations to return the money to bank depositors back to them. This created a domino effect, and depositors lost confidence in the banks & the financial system (the house of cards).

Multiple bank runs started as clients simultaneously started to withdraw all their money. With the current digital age and access to banking by using mobile phones, these bank runs happened at a rapid phase never seen before.

I've explained in a previous newsletter how Silicon Valley Bank messed up by investing in bonds with longer maturity dates. To spare you some time for looking at previous posts. I will repost it here:

https://www.romanornr.io/market-research-newsletter-march-12-2023/

I highly recommend reading the older newsletter if you didn't.

If you aren't planning to do this and instead try to skim over this article, quit reading now and go back to watching TikTok.

Anyways, long story short, without the details (which can be found in the newsletter I've linked), Silicon Valley Bank was a large bank that catered to the high-tech sector startups and rich venture capitalists. Silicon Valley Bank invested most of its funds in long-term bonds, and with the Federal Reserve hiking interest rates aggressively, they were exposed to interest rate and liquidity risk.

Due to the rise in interest rates, the bonds declined in value. There's a reason people didn't notice that before but banks have "accounting tricks" up their sleeves to pretend they're stronger than they actually are. Think about FTX, who valued their FTT at the current price. In the case of the bonds, they priced it when it would be in the future, but people wanted their money out now. (To put it simply and not make this article long)

A bank run was triggered (reason in the previous newsletter, I swear to god I'm not going to keep spoonfeeding), and Silicon Valley Bank was forced to liquidate its assets disadvantageous price point and additionally forced to sell its bonds at a discounted rate as a result of depositors withdrawing their funds.

Now you may wonder where the hell I'm going to this with this recap but keep reading.

The money withdrawn from smaller banks went mostly into bigger banks. Goldman Sachs had the biggest money market gain of the three firms, taking in $52 billion, followed by JPMorgan at $46 billion and Fidelity at $37 billion.

In the past weeks, money market funds have seen their assets rise to a record high of $5.1 trillion. This is "dry powder" waiting on the sidelines for the rate cuts.

Now it wouldn't be me if I explained about "Money Market Funds," so I'll try to explain

Money Market funds

Money market funds are a mutual fund variant that focuses on investing in short-term debt instruments, cash & cash equivalents with high credit quality. They're widely recognized for their low-risk profile and high liquidity, providing investors with modest returns and an easy way to run to the door.

Money market funds generally allocate their investments to different financial instruments, including U.S. Treasuries, commercial paper, certificates of deposits, and repurchase agreements.

The increased money market fund assets suggest that investors prioritize safety and liquidity in response to this market volatility, uncertain macro-environment, war, and uncertainty.

Bank of America saw a large surge in its assets, amounting to $300 billion over the last weeks. As of March 2023, the total assets of these funds have reached a record high of 5.1 trillion.

The scenario implications present a mixed outlook for investors in money market funds. The potential impact of lower interest rates on money market funds is noteworthy. It can reduce the income these funds generate, potentially making them less appealing than other fixed-income alternatives.

On the other side, a decrease in interest rates may potentially result in a surge in demand for money market funds, given their "perceived" safety and liquidity in a low-yield environment.

The potential for money market funds to experience improved credit quality and reduced default risk is worth considering, given the Federal Reserve's effort to bolster the financial system through bond purchases.

At the same time, even as the Federal Reserve continues to support the economy and bond market, money market funds can be vulnerable to surprises such as geopolitical tensions or changes in monetary policy.

All and all, money market funds are still an attractive option for risk-averse investors to retain some exposure to the bond market.

Things that will be covered: Rate hikes, Rate cuts, CMBS & CRE, SLOOS, YCC, Yield Curve Steepeners, SPX500 potential local top and final bottom

The rest of this article is for premium subscribers only. A Discord discussion channel for premium members will be online within a week as a bonus; A subscription is $25, which will also include airdrop hunting which should cover the subscription fees if you stay subscribed & committed