Ponzi Financing

The University of Michigan released a survey last Friday with the news that's good for the economy, yet sent some fear through the markets but absorbed by the AI speculation pretty quickly.

Surprisingly, 1-year inflation expectations went against analyst predictions and increased by one tick to 3.4% for the month. In addition, 5-10 year inflation expectations also slightly increased to 3.1%.

This news and the lower-than-expected core inflation of 4.8% the week before put a damper on the recession expectations. While the 10-year Treasury yields rose a bit, it seemed the market didn't know how to take the news.

The difference between the US and China seems to make matters complicated. China had consumer price growth in June and accelerating producer price deflation, a troubling sign for export-depended countries like Australia and New Zealand. China's second-quarter GDP of 6.3% year-on-year, much lower than the 7.1% Bloomberg consensus, didn't help the situation either.

In addition, the People’s Bank of China and the central government are attempting to reflate the economy, but Mevissen predicts that any stimulus efforts will be much more modest than witnessed in the past due to high debt loads and a smoldering real estate crisis.

To simplify it all a bit and leave all complex terms behind

Imagine you're watching a magic show on TV or wherever. Anyways, the magician pulls a rabbit out of an empty hand. That's kind of like the economy right now. At first glance, things look good. People are feeling okay about their financial situation.

That's what the University of Michigan survey is saying, but just like that rabbit, there's a lot going on behind the scenes.

Inflation, you know, when the prices of the things we buy increase more than expected. A higher grocery bill all of a sudden. This also makes people unsure about the stock market (if the Fed commits to combat inflation) and the bond market—the place where people lend their money to the government and companies for some yield.

Meanwhile, in China they got the opposite problem. Their prices are going down, which might sound awesome, but it's not a good thing if prices are going down too much.

It's like you're trying to sell your old car, but everyone keeps bidden a lower price for your car. China's also buying and selling less with other countries which might be problematic for Australia and New Zealand who rely on trade with China.

Now think about the real estate market as a big game of Monopoly. Normally the idea is to buy properties (houses, hotels, buildings, etc) and then charge rent when they land on your space. You're supposed to make more money from the rent than they owe you on the property.

But the game is getting tricky. Less people need office spaces because mroe and more people are working from home now. This was the solution during the covid pandemic and companies realized they don't need that much office space.

So the people who own these office buildings aren't making enough from rent to pay what they owe. It's like having a property on the Monopoly board that no one lands on.

It's not just commercial real estate (office spaces/buildings). The situation is tough for homeowners too. People who bought houses recently might be in for a bitter time. Imagine buying a property on Monopoly but then not having enough Monopoly money to pay the bank back because no one's landing on your space. That's what's happening.

The problem gets even more complicated when the banks are giving out longer mortgage terms. It's like borrowing Monopoly money from the bank and promising to pay it back but over a longer time.

You also know why a 30-year mortgage can be bad. Consider buying a house for $400k with a 20% down payment and 7.03% interest. You will spend the first 10 years paying off the interest alone instead of the house.

Now compare that to a 10-year mortgage.

All these little issues could combine to create a big problem. It's like if you're playing a game of Jenga and keep pulling out blocks, hoping the tower doesn't fall. But the more blocks you pull out (or risks you take), the more unstable the tower becomes.

If the economy's not careful, it could all come crashing down. That's the so-called 'Minsky Moment.'

So, while the rabbit out of the hat trick looks cool, we should be cautious about what's happening behind the scenes.

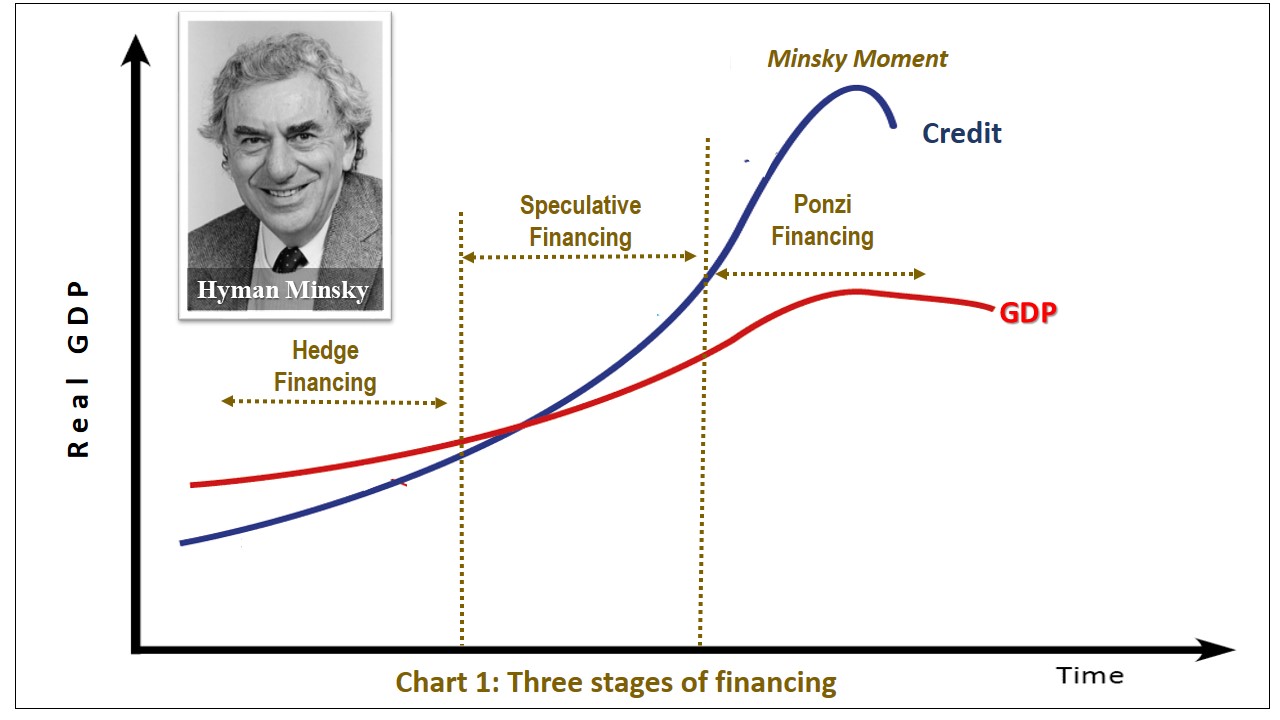

Minsky Moment

The term "Minsky Moment" was coined by economist Hyman Minsky to describe a situation where prolonged economic stability leads to an unsustainable situation, ultimately causing an economic crisis.

This happens when people engage in speculative activities, such as borrowing money with the expectation that asset prices will rise. If too many people do this, a significant drop in asset prices can lead to a financial crisis.

The concept of a Minsky Moment has recently resurfaced due to the rise in global inflation and the central banks' response. The University of Michigan consumer survey released last week showed that consumer sentiment and expectations all surged. However, inflation expectations were pushed higher. This was in contrast to the CPI inflation report, as previously mentioned.

There are increasing concerns about the stability of the real estate sector, particularly in the West. Up to $1.5 trillion of commercial real estate debt is due for refinancing over the next three years. In the near term, $270 billion alone is slated for refinancing this year.

This may be a serious issue. With sinking property values, the willingness or ability of banks to refinance these debts comes into question. A refusal could lead to a number of loan defaults, which would ripple through the economy, affecting other sectors and potentially leading to a broader economic crisis.

Economist Hyman Minsky's theory on economic instability helps explain the dangerous transition that might be happening. Minsky identified three stages of financing:

- Hedge financing

- Speculative financing

- Ponzi financing

Right now, the real estate market appears to be in the speculative financing stage. This is when the income from an asset, like a property, can cover the interest payments of a loan but not the principal or original amount borrowed.

If property values continue to decline and income from properties drops, we could enter the treacherous waters of "Ponzi financing".

The decline in office space demand has caused a decrease in property valuations. This shift may indicate that commercial real estate has moved from speculative financing, where cash flows can cover financing liabilities but not the principal, to Ponzi financing.

In this stage, the income from the property isn't sufficient to cover either the interest or the principal, often leading to selling assets or refinancing. With refinancing potentially off the table, this could push the market toward a crisis.

Meanwhile, on the residential side, the UK and Australia are wrestling with their own unique issues. The Bank of England's current policies doesn't support mortgage relief, potentially leaving struggling homeowners without a lifeline. Over in Australia, the central bank's lack of a financial stability mandate raises concerns about its ability to prevent a financial crisis.

Adding fuel to the fire, house prices in the UK are rising at a snail's pace. An increased risk of negative equity for recent borrowers, especially those who took out loans with small deposits. Negative equity is where the risk is even higher for people who borrowed a lot compared to their deposit (also known as high Loan-To-Value borrowers).

Before continuing to read, subscribe to the premium newsletter. The premium package also includes full access to my Discord.

If these people lose their jobs, as expected with a predicted rise in unemployment, they could default on their loans. With so many loans potentially turning into Ponzi-financing situations, this is another risky situation for the economy. This raises the specter of residential real estate slipping into "Ponzi financing" territory too.

So, when you put all these elements together: rising inflation, risky commercial and residential real estate situations, and shifting financial burdens to future generations.

The years of governmental support for first-time home buyers, through lowered deposit requirements and the unusually cheap loans offered by central banks, could well have created a 'Minsky Moment' time bomb within our economy, due to unsteady real estate markets.

You've got the perfect storm for a Minsky Moment.

ApeX DEX

Problems with KYC exchanges?

Consider ApeX DEX,, which is in my opinion, the best Decentralized Exchange there is

Instructions:

https://twitter.com/RNR_0/status/1652360705331347461

Signup: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

Ref code: 46

Bybit

Still prefer Bybit? Sign up to Bybit with my link for a deposit bonus of up to $30k: https://partner.bybit.com/b/6776

Are you looking for a Centralized exchange without KYC?

Try Bitget: https://partner.bitget.com/bg/Z9VWRV