Market Research & NFT airdrop: Mar 10 - 2023

On March 8th, Federal Reserve Chair testified in the second round and clarified that he had not decided whether the next rate hike would be 25 bps or 50 bps. Before deciding, he also clarified that he would look at the Job Openings and Labor Turnover Survey (JOLTS), payrolls, and CPI data. Those advocating for 50bps were fortunate because JOLTS data came in much higher than expected; that's strike one.

The global markets have been extremely volatile lately, especially in the US equities markets. The SPX500 closed red yesterday, down 1.8%

SVB Financial, a Californnia-based lender to the venture capital industry, has been hit extremely hard, and the losses are now sparking speculation that this will affect other banks and affect the bond portfolios of US banks.

Also Crypto NFT airdrop at the end of newsletter, scroll down

SVB Financial

So the recent news surrounding overnight losses incurred by Californian bank SVB Financial has raised serious issues regarding unrealized losses on bond portfolios and their impact on bank capitalization levels. The Federal Deposit Insurance (FDIC) projected that the US banks had around $620bn of unrealized losses on securities that were held to maturity or available for sale accounts. This will have implications on the Forex markets too.

The most notable impact of this news was an immediate deleveraging of open FX positions. This was seen through large losses in EMFX currencies, such as the Mexican peso and Hungarian forint, which dropped 2.2% and 0.8%, respectively.

G10 currencies experienced a more mixed result, with higher-beta currencies such as the Canadian dollar and Norwegian Krone losing around 0.3% of their value against the US dollar.

The outperformed was the Swiss Franc, which gained 1.1% against the US dollar. The outperformance may have been partly due to the traditional safe-heaven status of the currency, as well as the recent commitment by the Swiss National Bank to prevent any significant weakening in the franc.

The US dollar experienced a similar mixed result due to both the sell-off in US equities and potential implications of the development US banking system and the Fed's ability to push ahead with the aggressive tightening cycle previously planned. That and the US 2-year Treasury yield drop over the last 2 days alone.

Note: I've been sick for a week, sneezing and having a leaking nose. I couldn't sleep. I woke up way too late to write this newsletter. I'm still sick, but I still try to write while keeping my head up, so the snot doesn't leak out of my nose. I wish I could have written this newsletter hours earlier (before Non-farm payroll, at least)

However this newsletter will be a short one since I can't optimally focus and the market keeps moving as I write. I will try to write more newsletter in the upcoming week when I'm recovered.

Overall, the news of overnight losses has serious implications for FX markets. Monitor further developments in the US banking system. It may be wise for investors to consider diversifying their currency portfolios and taking positions in the Swiss franc & Japanese Yen for today. The reason for the Japanese yen is that the Bank of Japan has maintained its monetary policy and has not adjusted it overnight in reaction to the news

(Well, this newsletter will be pushed too late, so yeah, ignore this one since JPY and the Swiss Franc made their moves)

DXY could fully retrace back down to where it started

(This can also be ignored because this already happened while writing too late)

Normally this newsletter (which would be longer normally) is for premium members, but since I am late today and sick, I am releasing it publicly so anyone can read it. So this one is for free; however, if you are interested in subscribing to the newsletter, you can.

See the newsletter subscription option.

However, the newsletter doesn't end here; scroll down further to continue reading

Newsletter Premium Subscription

Premium subscription

Tired of seeing low-effort content on Twitter with random people posting lines on a chart?

Maybe subscribing to this newsletter is something for you to gain an edge over the market.

Also, read my free medium articles: https://medium.com/@romanornr/

Full access to exclusive premium content

Subscribe, and get a competitive edge over the market.

Take the first step to kick your wife's boyfriend out of the house & stop getting liquidated.

US 2-Year yields rise as Fed & BOC reassess rate policies

I admit that a comprehensive understanding of the current state of US 2-year yields is hard. Considering the implications between the US 2-year yields, Fed rate, Bank of Canada rate, and the implications that each of these has on the economy overall.

US 2-year yield has exceeded 5%, and investors expect higher borrowing costs soon. This can have a negative impact on economic growth as businesses as consumers will be less likely to take out loans or borrow money

The Federal Reserve's rate currently stands out at ~6%. The rate is set by the Federal Open Market Committee (FOMC) and is used to influence the level of economic activity in the US. Their tool to raise or lower interest rates is to control inflation, stimulate economic growth or prevent further growth if the economy is overheated.

The Bank Of Canada's rate is currently sitting at ~4.5%. The Bank of Canada, meanwhile, recently didn't move their rate from 4.5%. They are still assessing whether or not more needs to be done. The Bank of Canada is being somewhat more cautious when it comes to managing its rate-setting strategy.

Keep an eye on the activity of the Federal Reserve and Bank of Canada as their rate settings policies can have strong implications.

EURUSD

A recent shift in the SVB Financial-influenced Federal Reserve Curve and its effect on the 2-year EUR:USD swap differential.

The FED sets a benchmark interest rate (Federal Funds rate) and other short-term borrowing costs, which helps to determine market-determined interest rates.

The SVB Financial-inspired repricing of the Federal Reserve Curve results from the shift in market expectations regarding the Fed. The Federal Reserve has recently expressed its hawkish views of future economic policy, leading the market to expect higher interest rates. This has influenced steepening of the yield curve, long-term rates are increasing faster than short-term rates as investors demand higher returns from longer-term investments in a higher-rate environment.

The steepening of the yield curve has had a significant impact on the 2-year EUR:USD swap differential. A swap differential happens when investors or company exchanges rates between 2 different currencies, usually for the purpose of hedging their currency exposure

Right now, the 2-year EUR:USD swap differential has narrowed by 20bps for the euro over the last 2 days. Indicating that the euro's value has strengthened relative to the USD dollar, providing support to EURUSD.

A soft NFP job release could be seen as a sign that the Federal Reserve doesn't have to be as hawkish in its monetary policy as Jerome Powell previously suggested. This can result in a weakening of the US dollar, which could lead to a further narrowing of the 2-year EUR/USD swap differential in favor of the Euro and potentially send the EUR/USD back to its starting level of ~1.07

The effects of this shift in the yield curve have also been felt in other currencies. Going forward, there may be some upside risks to the value of the koruna, but this is unlikely to have a major impact on the Czech National Bank's policy settings.

All in all, the recent shift in the yield curve, as caused by the SVB financial-inspired repricing of the Federal Reserve Curve, has had a marked effect on the 2-year EUR/USD swap differential, sending the euro's value higher.

Going forward, there may be some upside risks to the value of the koruna, but this is unlikely to have a major impact on the Czech National Bank's policy.

CAD

Canada released their payroll jobs figures.

In the latest policy announcement by the Bank of Canada policy markets, they adopted a "disinflationary" narrative which implies that the tightening efforts taken may be coming to an end. Despite the payroll data, it may not be enough to bring about any new interest rate hikes.

So there's a short-term upside for USD/CAD but a bearish outlook over the medium term as the USD might decline.

If you're enjoying this newsletter, consider signing up for a premium subscription, a discord discussion server will be launched soon as an extra for premium subscribers

Dutch Government restrictions on exports of Advanced Chips to China

In recent years, the Netherlands has been one of the world's top exporters of highly integrated electronic chips. These chips are important in many fields, from mobile phone service to health care. China is a big market for these chips.

But the international community is putting more and more pressure on China to stop these exports. This is because the US says China could use this advanced technology to control global economies and military operations. So, the Dutch government just announced new rules that will make it harder to send high-tech chips to China.

Two things are most important about this new rule. First, it will cause a lot of trouble for the Dutch chip industry because the Chinese demand for advanced chips is likely to go down. Second, it could have far-reaching geopolitical effects that make it harder for China to access the Netherlands' newest technologies.

But there is also a chance that this new rule could open up new opportunities. The Netherlands will now be able to offer advanced chip technology to countries other than China. It could also work with international organizations to ensure the technology is properly evaluated and regulated.

Gtrade

I've noticed this interesting DEX. So gTrade has a really nice UI but also has forex and stocks. I am still playing with the DEX. I recommend using the Polygon network to trade on the.

It's a decentralized alternative to PrimeXBT. The difference here is that you can trade decentralized using Polygon & Arbitrum.

There's no SPX500 to trade but you can trade SPY, also stocks such as Google, Tesla etc

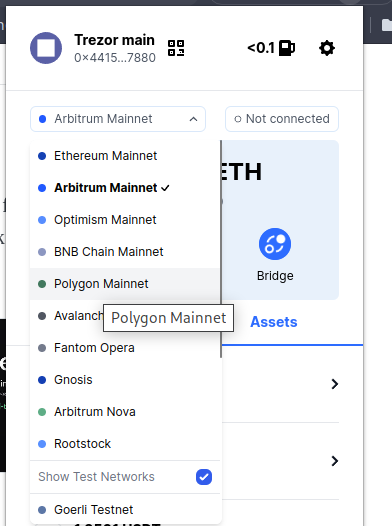

Again, switching from network and bridging is easy with Blockwallet

link: gains.trade/referred?by=romano

PrimeXBT (If you're looking to execute trades)

If you're looking into trying to trade Forex, US equities markets, commodities, and CFDs. You should check out PrimeXBT.

PrimeXBT is a crypto-based platform that enables traders to access multiple assets and markets, including cryptocurrencies, stocks, commodities, CFDs, and forex.

PrimeXBT is an online broker that allows traders to trade with leveraged trading, offering up to 1:1000.

With PrimeXBT, traders can open and close positions quickly.

The minimum deposit is about $10, and no KYC is required. PrimeXBT users can buy Bitcoin, USDT, and USDC using a credit card in the client dashboard.

I have been using PrimeXBT to test out, as I've been looking for a broker to trade the SPX500, Forex, and commodities.

Here is my advice, as I've been testing. I prefer not to use Bitcoin as my collateral but instead USDT or USDC.

As bitcoin can be volatile and correlated, your collateral can go down as bitcoin goes down, so risky business. That's why I prefer using stablecoins as collateral.

Make sure to fund either the USDT or USDC instead of margin BTC.

When you're using stablecoins as collateral, it's easier to place a stoploss and see how much you will be losing. This might be slightly off due to spread etc.

When having a position open, it looks like this.

I used multiple orders over a few days, and you can close each trade if you like by pressing the "x" button.

So if you've been following my newsletter for a while, you know I cover legacy markets, options, cryptocurrency, Forex, commodities, etc.

Many of you haven't been able to profit due to not having access to trading stocks/CFDs/commodities.

I suggest trying out PrimeXBT; I have heard about positive experiences with PrimeXBT from other traders.

My referral link for PrimeXBT: https://u.primexbt.com/rnr

Depending on the deposit amount, you can receive up to a $7000 bonus when registering with my referral link. Note that's the maximum bonus.

Promo code: rnr

I recommend creating an account and playing with $300 - $500 or an amount you don't care too much about just to practice first.

Don't take it too seriously, as you're just practicing. It's important to also look at legacy markets since everything is connected.

If you like trading on chain, go for Gtrade but if you prefer a centralized exchange, chose PrimeXBT

I would recommend practicing on PrimeXBT since there are no TX fees, and you can play with small amounts since there are no gas fees costs etc.

On Gtrade however, your leveraged trades are isolated. That's a huge benefit! If a bank intervenes, at least not, your entire account will be blown up when price goes against you overnight or gaps up/down

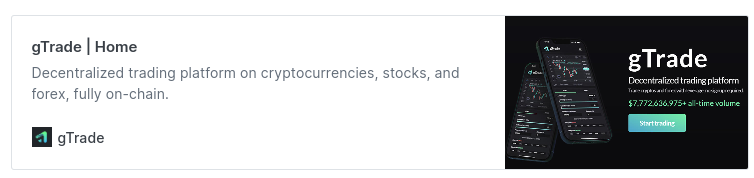

Blockwallet

I've been recommending Blockwallet in several tweets.

I made the switch from Metamask to Blockwallet.

The user interface and functions are much better; it works better with my Trezor and switching between accounts. Extra privacy, flash bot protection & anti-phishing. You can also import your Metamask seed, etc.

However, I've seen one of their latest tweets, BlockWallet has a token called "BLANK"

Kicking off the new year with some heat - the $BLANK token burn 🔥 pic.twitter.com/rm83xOo0wt

— BlockWallet 🔲 (@GetBlockWallet) January 16, 2023

If I were a betting man, which I am. I will assume that Blockwallet users are eligible for a nice airdrop. I would recommend installing Blockwallet and making some transactions.

You can export your Metamask seed and import it into Blockwallet. As some people think, there's no need to reshuffle your assets. Some people don't want to make the switch because Blockwallet has no mobile app right now. It doesn't matter. You can install Metamask or 1inch wallet on your phone and import your seed on your mobile wallet, which is not Blockwallet.

Chrome extension link: https://chrome.google.com/webstore/detail/blockwallet/bop

Apex Dex by ByBit

Reminder Apex incentive program, which pays you to trade and keep tour trade open, is ongoing.

They pay rewards to keep that position open lmao

— Romano (@RNR_0) January 12, 2023

Grand idea (however, maybe it won't work)

Use 1 wallet to long x amount

Use 1 wallet to short same amount

Farm rewards neutral?

Discount ref link code: https://t.co/JsJlHH5k3s

Ref code = 46

disclaimer: I hold 1 ApeX OG NFT pic.twitter.com/SgtbrREWS6

Think I can close it for a moment now

— Romano (@RNR_0) January 16, 2023

I like trading on Apex. I get rewards in BANA tokens as a reward

Basically, 1/3 position size as a reward/incentive to trade@OfficialApeXdex is a DEX from ByBit

Interface identical

Can recommend trying out https://t.co/JsJlHH5RT0 pic.twitter.com/Le0Y0y8X9d

If you need a referral link: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

My referral code is: 46

In my opinion, this is the best DEX for trading bitcoin futures.

They also have a mobile app, Android:

Also, an app for iPhone

Ref code = 46

NFT airdrop

NFT airdrop

Backed is a decentralized NFT lending platform designed to empower users in the DeFi space.

It provides users with the ability to utilize the NFT ecosystem and leverage their existing tokens in the process.

Through the platform, users can mint their own soulbound (non-transferable) NFTs that reflect their activity on the Optimism platform.

In addition, Backed also provides users with some tokens if they are among the owners of NFTs with the most features.

This token reward is meant to encourage users to increase their activity on the platform.

To bridge your ETH to Optimism, I used https://synapseprotocol.com/

Visit https://www.withbacked.xyz/community

Become an affiliate of this newsletter.

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me, as compensation for promoting/sharing the newsletter with others.

Payouts can be in crypto or through a bank.

Newsletter affiliate

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me as compensation for promoting/sharing the newsletter with others.