Market insight May 31, 2022

Bearish traders have suffered recently as sharp equity gains have erased their gains!

Similarly, bullish traders/funds are still struggling as they have incurred losses year-to-date.

The neutralization of rebalancing flows has almost been completed.

When the inflows and outflows of a certain asset are equal, the rebalancing flows are neutralized. That may happen when the asset's price changes dramatically. Investors will buy and sell the asset to adjust their portfolio (Portfolio rebalancing)

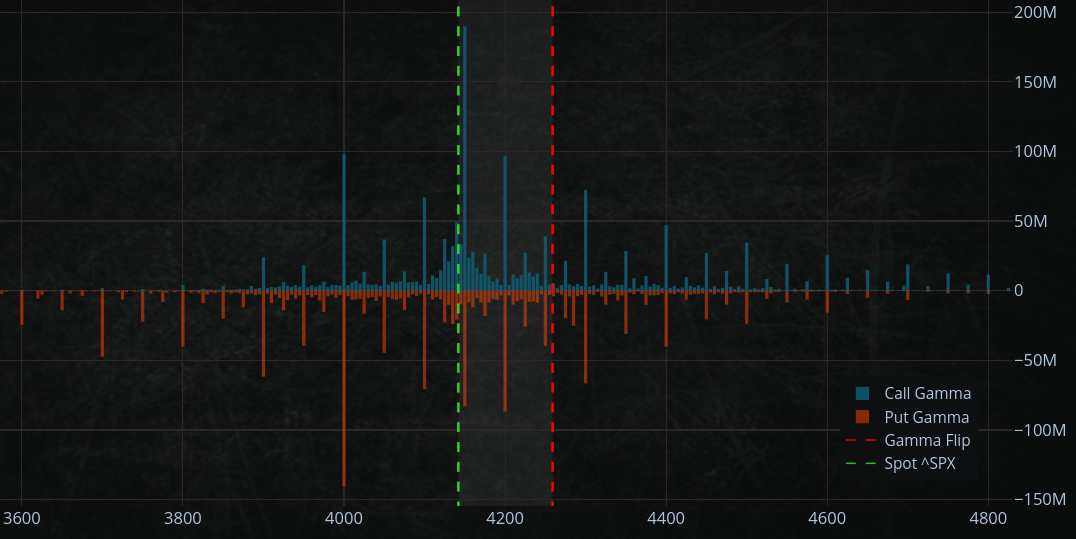

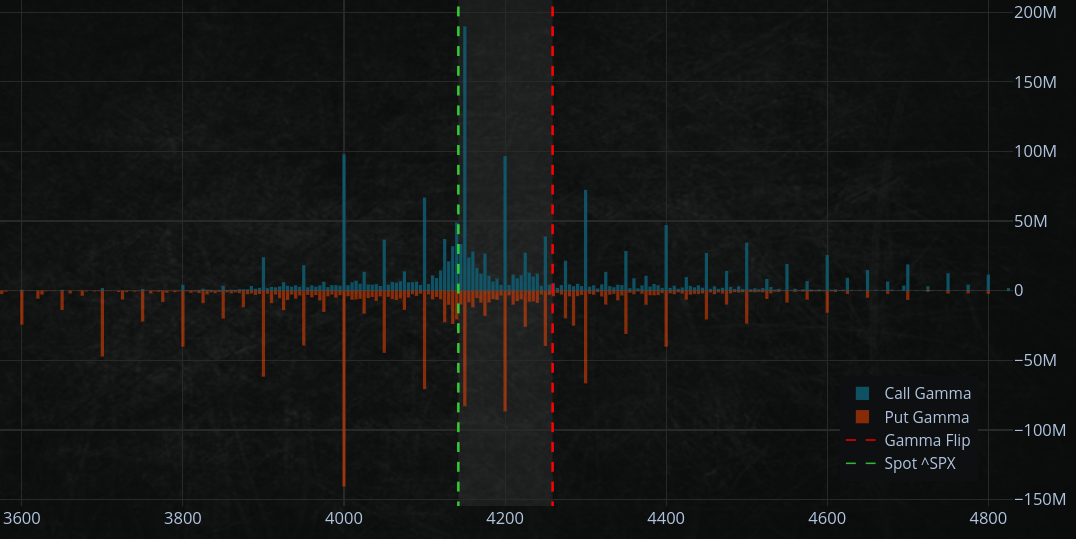

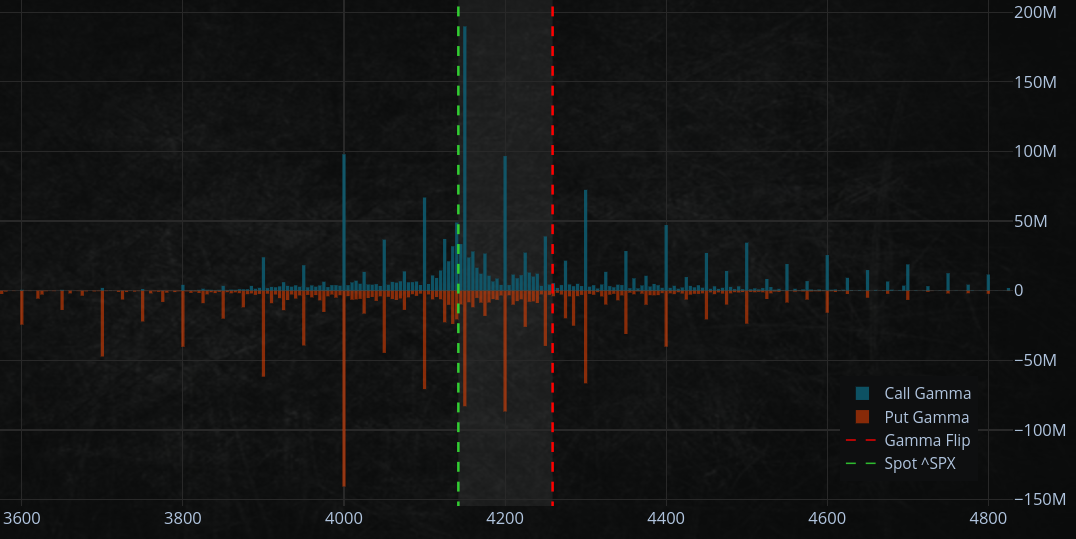

Negative gamma & inelastic demand from passive flows

What's an increasingly inelastic market?

When many people want to buy something, but not many things are available to buy, prices go up. That's what we call an "inelastic market."

This market is an example of how negative gamma can have an impact in both directions.

Gamma is measure of the rate of change of an option's delta. Delta is the amount by which an option's price will change for a given change in the underlying asset price.

If you're unfamiliar with the option greek "gamma," I have written a post about the relationship between gamma and delta. Also, how delta hedging works when being "short-gamma."

https://romanornr.medium.com/options-trading-part-3-gamma-curvature-risk-9f6dd4b3db5b

Negative Gamma

A negative gamma indicates that the option's delta will decrease when the underlying price rises. As the underlying price climbs, it becomes less probable that the sold call option would expire "In the money."

Conversely, a positive gamma indicates that the option's delta will grow when the underlying asset price rises. As the underlying asset price rises, the option will have a greater chance of expiring "in the money."

The inelastic demand from passive flows shows that investors do not respond to market swings since they continue to invest in an asset regardless of whether its price is growing or declining.

However, it is essential to note that we remain in negative gamma and that the expiry of the large selling of call options by hedged equity strategies will result in a sizeable quantity of new call options to sell at the end of today.

These enormous hedging strategies cause dealers and market makers to net sell futures to balance the index calls they get and (as usual) produce end-of-day selling pressure.

About who am I talking to? Remember this tweet. JPMorgan Hedged equity fund (JHEQX)

JPMorgan Hedged equity fund (JHEQX)

— Romano (@RNR_0) April 1, 2022

SPX500 Delta hedge finally expired ($10 billion dollar)

3810 Put 31 Mar | Open interest: 43011

4510 Put 31 Mar | Open interest: 43019

4920 Call 31 Mar | Open interest: 43340

JPMorgan roll is today if I'm correct!

Further outlook

Over the next two weeks, I remain doubtful that the market will go much higher for several reasons, such as the diminished impact of negative gamma and Vanna and the possibility that major traders will protect downward holdings leading up to June 15.

On the other hand, I think traders may sell short-dated volatility (i.e., expirations on June 15) in response to any volatility spike or market collapse, which might support and aid in lowering volatility.

Rallies into June OPEX (June 17) should be labeled as potential "short coverage" psyops and prone to sharp reversals down.

however, a rally to $4300 is doable. I think

Note that FOMC is on June 15

SPX500 Option "put wall" strike price $4000

I think the SPX500 will be supported at around the $4000 level through June options expiration.

What's a "put wall"?

A "put wall" is a cluster of put options contracts at the same strike price. It acts as a support level because there is a high concentration of open interest at that strike price, meaning that there are a lot of traders betting that the price will not fall below that level. Therefore, if the price starts to fall, there will be a lot of selling pressure to prevent it from falling below the strike price.