Market insight June 2, 2022

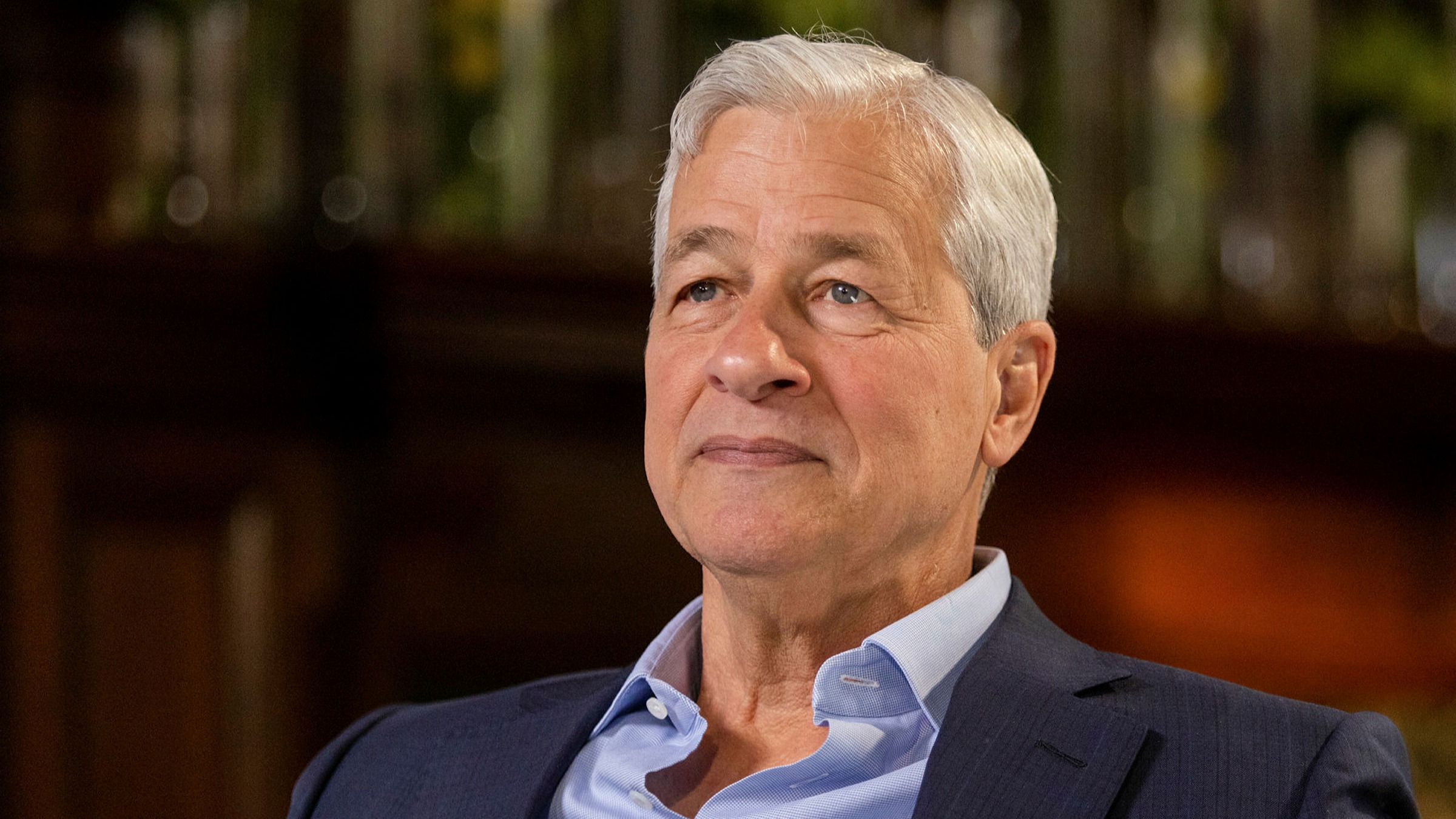

Following warnings from Jamie Dimon, markets immediately returned despite an early rally.

This emphasized the market's riskiness and the negative gamma that has been afflicting it.

This market is an example of how negative gamma can have an impact in both directions.

Gamma is measure of the rate of change of an option's delta. Delta is the amount by which an option's price will change for a given change in the underlying asset price.

If you're unfamiliar with the options greek "gamma," I have written a post about the relationship between gamma and delta. Also, how delta hedging works when being "short-gamma."

https://romanornr.medium.com/options-trading-part-3-gamma-curvature-risk-9f6dd4b3db5b

But that negative gamma is slowly getting smaller, and the lack of close-to-close volatility makes it easier for Vol Control strategies to come back.

What are Vol Control strategies?

Vol Control strategies are methods that investors use to protect themselves from the problem of negative gamma. These strategies involve buying or selling options to offset the effects of gamma.

Quantitative tightening

Quantitative tightening is not like flipping a switch that sends markets into chaos right away.

We don't know how much of the big drop in discretionary positions is due to QT (Quantitative tightening)

Some investors may have anticipated quantitative tightening and have already divested from their positions. This means that there is less buying pressure in the market, which could cause prices to fall.

Even if hedge funds and CTAs might switch net short of increasing selling pressure, there is a possibility that offsides positioning could lead to another upward advance if retail investors don't quickly join.

What are CTAs?

CTAs are commodity trading advisors, a type of investment manager who trades futures contracts.

SPX500 put options with a $4000 strike price

We remain in negative gamma, indicating that intraday volatility increases as traders are pressured to follow market moves.

SPX500 $4000 put option expirations continue to impose the greatest negative pressure. Still, sideways consolidation has led to a more symmetrical open interest, stabilizing the market and driving traders back into positive gamma. The market should continue to increase as long as flows are net positive.

It's more likely that the SPX500 range between 4100 and 4200. If we break below 4100 could lead to a quick test to 4000 level.

As we head into next week, 4000 is still a strong support level, so traders might want to buy downside protection (ie, VIXY) while it's still cheap.

QQQ

The most active options strikes for the QQQ ETF are the 300 and 310 strikes, indicating that these will be important levels to monitor next week ahead of the FOMC meeting.