Market insight, August 11, 2022

The lower-than-expected inflation rate reported yesterday boosted asset prices across the board, with huge gains seen in sectors underperforming in recent weeks.

In the financial markets, a lower-than-expected inflation rate often leads to a rally in asset prices. That is because investors feel that lower inflation will lead to higher corporate profits and better economic growth.

In addition, a lower inflation rate makes it easier for the Federal Reserve to keep interest rates low, which is generally good for the stock market.

We saw strong gains in sectors that have been underperforming in recent weeks. That suggests that a good portion of the move was due to "short-covering," as investors who had bet on further declines in asset prices rushed to close their "short positions."

However, let's not celebrate too early.

There is downside potential that may catch some market participants off-guard. After all, prices have unexpectedly started to rise again. That is because market participants are "short-covering", which means that they had bet on asset prices going down by shorting the market and are only buying back in.

That buying pressure pushes prices higher in the short term, but if prices start to fall again, these investors will be forced to sell at a loss. That mechanic can create a downward price spiral, leading to significant losses for investors.

Is the FED serious about fighting inflation, or are they full of shit?

The FED being serious about fighting inflation is possibly psyops. If they are, they should hike rates more aggressively.

It is important to remember that the Fed has been known to reverse its stance in the past rapidly. A few months ago, the Fed did not consider a rate hike of 75 basis points a possibility. A week later, the Fed ultimately implemented the same rate hike. Therefore, one should be wary of placing too much weight on what Federal Reserve officials say since they might be full of shit.

Oil and inflation

The present state of inflation in Japan is characterized by a 20% depreciation of the yen versus the dollar, resulting in a 20% rise in the cost of goods priced in dollars for those using the yen. In conjunction with the pre-existing worldwide shortage of these commodities.

This substantial increase in the price of necessary goods and services has a recessionary effect since it reduces consumer demand. People simply cannot afford to pay increased prices for necessities while still maintaining discretionary expenditure on other products and services.

It is essential to keep in mind that margins determine pricing. For instance, oil prices would rise if the oil supply decreases by millions of barrels per day. However, if oil demand decreases by millions of barrels per day, the price of oil will decline.

As the price of oil declines, oil exporters will earn less money and pump more oil to compensate. Consequently, this further depresses prices.

In conclusion, a strong dollar and a worldwide recession would be advantageous for the United States since they would decrease the price of all imports.

Those using weaker currencies, meanwhile, would pay more for imported goods. In addition, a decline in oil consumption would hurt oil exporters while benefiting consuming countries.

Commodity trading advisors (CTAs)

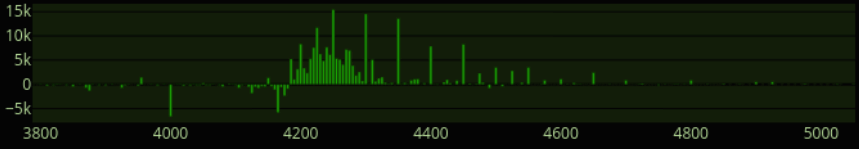

Commodity trading advisors (CTAs) automatically use computer models to trade futures contracts. These models are based on a variety of factors, including price trends, volatility, and momentum.

The computers that CTAs use are no longer short, meaning they are no longer betting on a price decline.

The computers are now long around $3.5bn, which means they are expecting a price increase.

With the aggressive move higher today, the CTA crowd needs to buy an additional ~11b S&P over the next 5 days to keep up with the move.

No computers chasing bitcoin?

The current lack of activity in the bitcoin market.

However, are the institutions slowly coming?

The investment company BlackRock has announced that it will offer bitcoin trading to certain clients using the Coinbase platform.

According to BlackRock, this move was made in response to customer demand. BlackRock already has a stake in Circle, the company behind the $54bn stablecoin USDC.

BlackRock's prominence as an investment company and because of the possibility that more investment companies could follow suit and begin offering bitcoin trading to their clients.

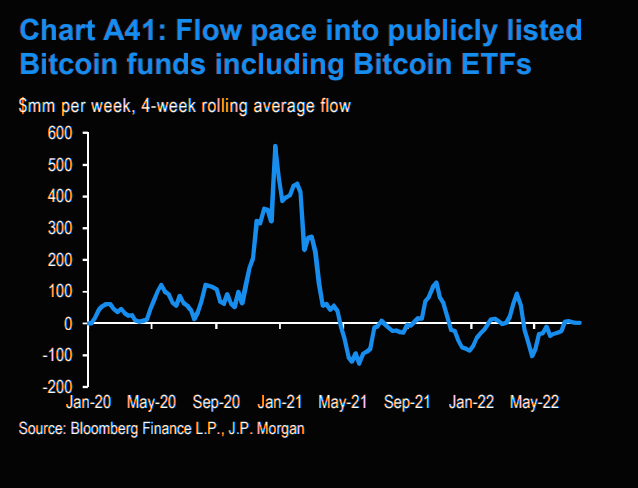

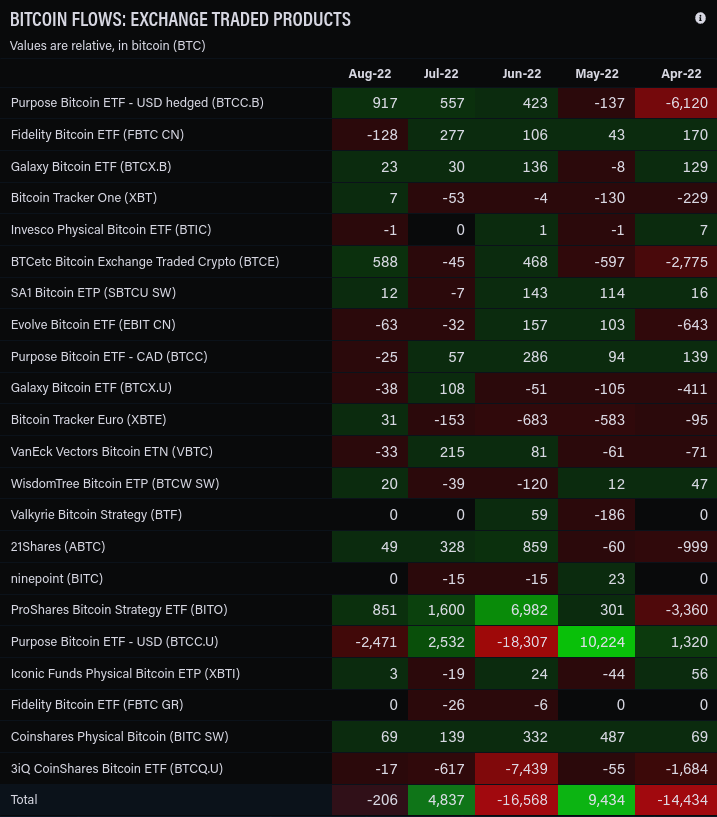

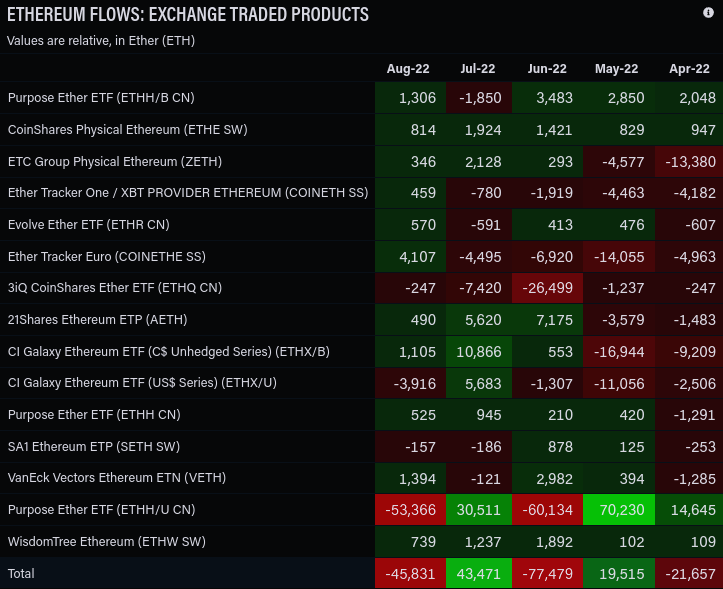

The flows, however don't look that great for bitcoin & ethereum.

They used to be the hottest assets a year ago.

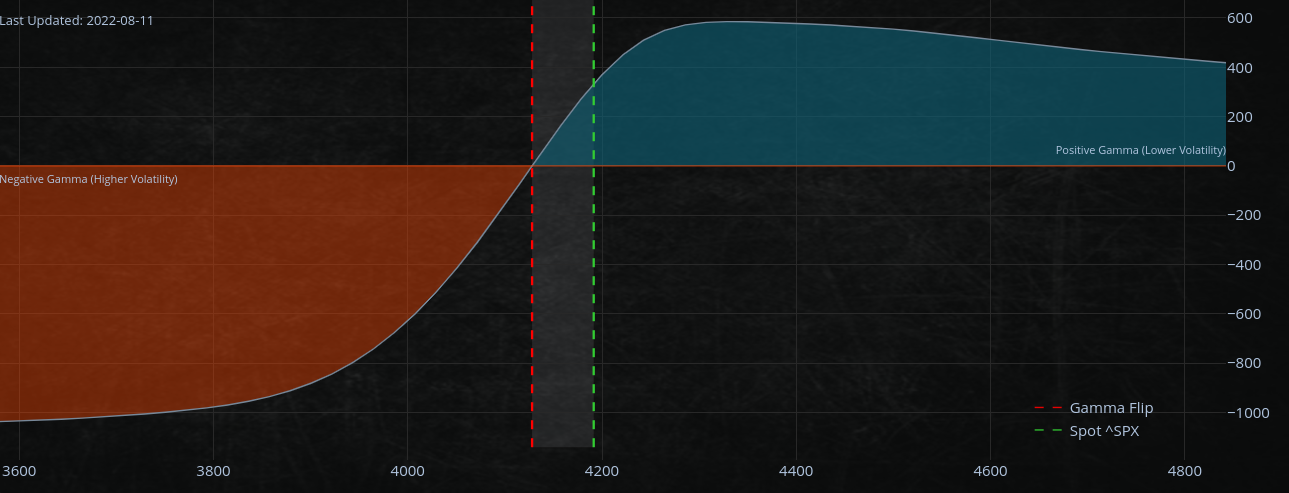

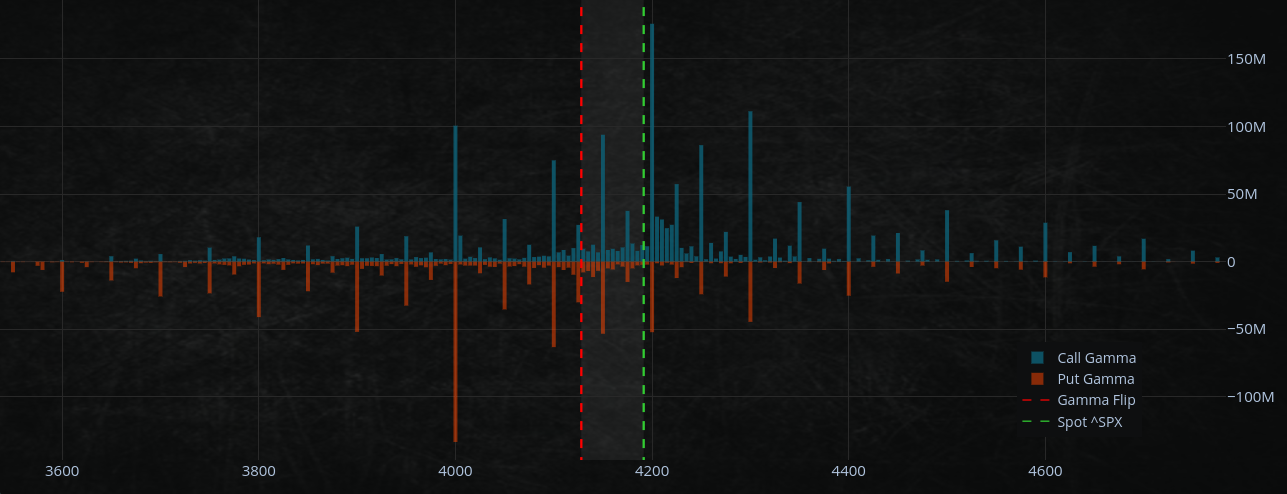

SPX500 option market & dealer positioning

Many assets, including bitcoin, have not reached new highs during the current rally. Some people ask themselves, and others "Is the bottom in?"

However, there are still some risks to this market recovery, such as geopolitical tensions and macroeconomic problems. Despite these risks, it is undeniable that we are currently in a positive gamma territory.

The increase in the gamma value for SPX500 $4200 calls indicates that market participants are beginning to buy up future contracts to profit from potential price movements.

These short-term call options offer dealers a strong incentive to chase and buy future contracts because they know they will gain delta as time passes.

Delta is the change in the option's price given a change in the underlying asset's price. So, as time passes and the underlying asset's price changes, the option's price will also change.

However, because the majority of these options are barely a week out from expiration, their decay becomes exponential. This means that they will lose value very quickly as they approach expiration.

With roughly $700-$800 billion in notional expiring this month, market makers have a difficult issue with summer August's low liquidity.

That is because a lot of money is set to expire this month and not a lot of liquidity in the market to absorb all of that expiring money.

What are the implications?

That means there could be a lot of volatility in the markets this month as traders try to find buyers for all the money that is set to expire.

That could lead to some wild swings in prices as traders attempt to unload their positions. It is important to note that this is just a potential scenario and that no one knows for sure what will happen. However, it is something that analysts and traders will be watching closely in the coming weeks.

Option contracts

If you don't have any idea what I'm talking about. I can recommend you read all my option articles on my medium page

You can find parts 3-7 on my medium page which I will link below but let's do a small recap for my "less motivated" readers

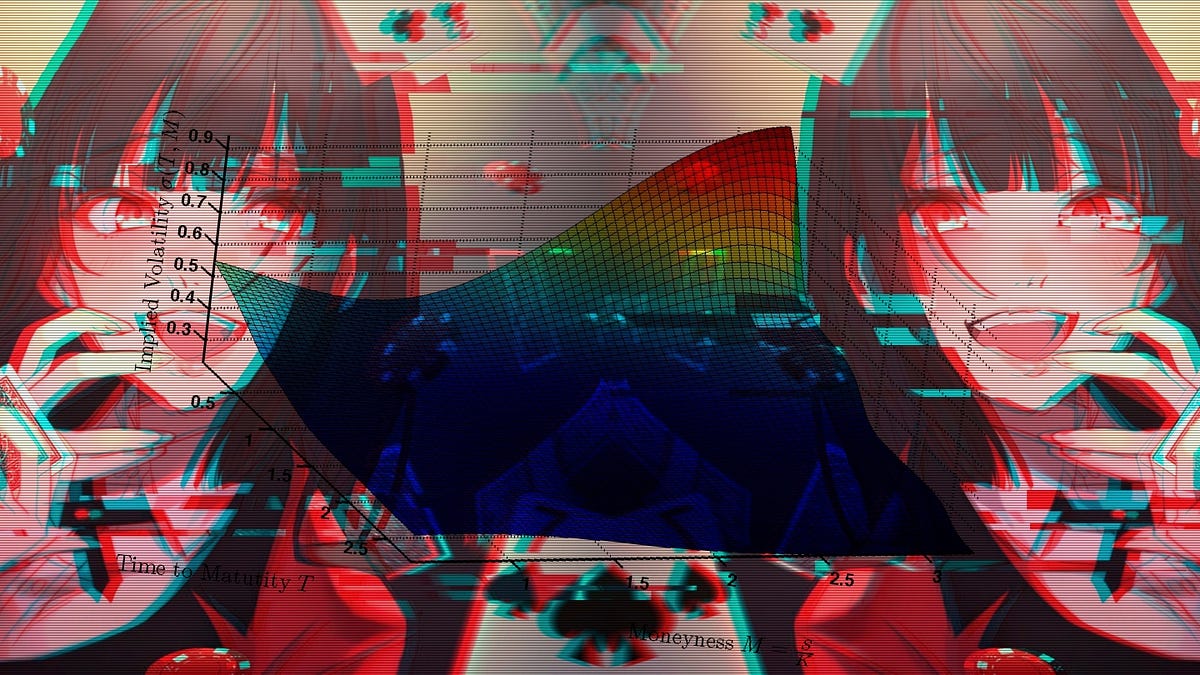

Gamma is a measure of the rate of change of an options contract's theoretical value with respect to changes in the underlying asset's price.

In other words, it tells us how much the theoretical value of an options contract changes when the price of the underlying asset changes.

If an options contract has a high gamma, it means that its theoretical value will change quite a bit when the underlying asset's price changes. That is because the options contract will have a higher delta when the underlying asset's price is closer to the options contract's strike price.

Delta is a measure of how much an options contract's theoretical value will change when the underlying asset's price changes. It tells us how much of the underlying asset's price movement will be reflected in the options contract's price.

If an options contract has a low gamma, it means that its theoretical value will change only a little when the underlying asset's price changes. That is because the options contract will have a lower delta when the underlying asset's price is further away from the options contract's strike price.

The gamma of an options contract is highest when the underlying asset's price is closest to the options contract's strike price.

Short-selling put options and call options to have a negative gamma while buying call options and put options have positive gamma.

Gamma is positive when the underlying asset's price is above the strike price.

The gamma of an options contract is zero when the underlying asset's price is equal to the strike price.

The delta of the options contract will be 0.5 when the underlying asset's price is equal to the strike price.

The delta of an options contract tells us how much the theoretical value of the options contract will change when the underlying asset's price changes. It is the slope of the delta of the options contract's theoretical value curve with respect to the underlying asset's price.

As expiration approaches, the gamma of an options contract will become less or less negative if the underlying asset's price is below the strike price.

This is because the delta of the options contract will approach 0 as expiration approaches.

The closer an options contract is to expiration, the more sensitive it is to changes in the underlying asset's price.

That is because the time value of an options contract decreases as expiration approaches. The time value of an options contract is the amount by which the theoretical value of the options contract exceeds its intrinsic value.

The intrinsic value of an options contract is the amount by which the underlying asset's price exceeds the strike price of the options contract. If the underlying asset's price is below the strike price, the options contract has no intrinsic value.

Really read all my medium articles about options, which is better to read since I break everything down

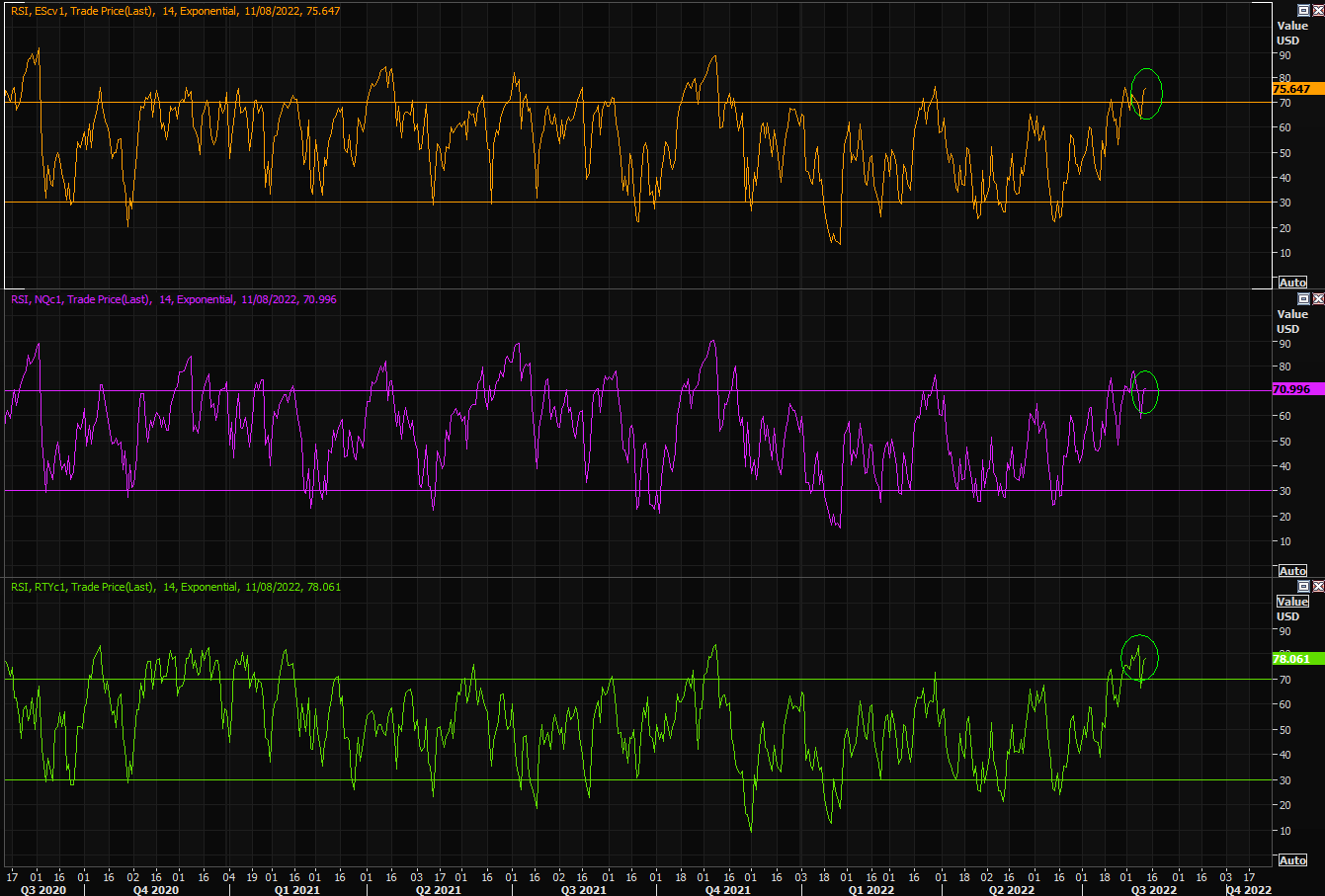

Are we in an overbought territory?

The markets are currently in a state of being overbought, which means that they have been bought at a higher price than what is considered normal.

However, it is important to keep in mind that overbought and oversold levels can stay at those extremes for extended periods of time. With that in mind, we will need to wait and see how this plays out. It is also worth watching for possible negative short-term RSI (relative strength index) divergences, which could indicate a change in the market trend.

SudoSwap

The development of products like NFTX and Sudoswap is helping to facilitate liquidity in the NFT market, which has been historically illiquid.

These products make it possible always to sell floor-priced NFTs, which is helpful for investors who want to maintain the investability of their collections, and also provides peace of mind for current investors.

Sudoswap in particular has seen a significant increase in trading volume over the past week due to its improvements that make each trade less risky and more profitable.

The Sudoswap protocol can significantly impact the NFT market by providing increased liquidity and new avenues for creators to earn revenue.

However, there are some drawbacks to Sudoswap that should be considered. One is that it doesn't pay royalties to creators, which may make some reluctant to use the platform. In order to overcome this, creators can set up pools containing their NFTs and ETH.

That not only provides liquidity for their NFTs, but also allows them to earn trading fees from the pool. Another potential issue with Sudoswap is that if the market for NFTs declines, pools could be used to rapidly sell unwanted NFTs, depleting the ETH in the pool. Overall, Sudoswap is a potentially powerful tool for those involved in the NFT market, but it is important to be aware of the risks involved.

0xmons, the creator of Sudoswap, has created a new currency called XMON.

While the XMON price is currently quite high, it could become attractive to purchase at lower prices if the market begins to sell off. One reason to believe that XMON holders will become eligible for a Sudoswap airdrop.

Sudoswap is a new platform that is still very small compared to the market leader OpenSea. However, it is disrupting the market and is due to be integrated into Uniswap, which could send volumes stratospheric.

Already, the amount of liquidity on Sudoswap is growing rapidly.

ETHW

The upcoming fork for ETH on the Ethereum PoW chain will result in a new name for the ETH token, which is ETHW. The value of ETHW will not be the same as ETH on the Ethereum PoS chain because it has the minority support of the Ethereum community. However, it can still be considered a "free airdrop."

Comparing the upcoming fork to the previous two major forks of Bitcoin and Ethereum, we can assume that the price of ETHW will fluctuate between 5% and 25% of ETH's value in the weeks following the fork but will eventually drop to less than 1% of its value.

Selling ETHW for ETH early is likely to be a good idea.

Why? Well selling BCH (Bitcoin Cash) after their chain war was a good idea. Most likely it will be a race to sell the "free aidrop" asap.

For example, you can also hold Ethereum spot & short ethereum futures contracts on FTX. You hold your Ethereum spot and get the airdrop while hedging out the down risk by shorting the same size of the spot you hold.

(Idea from Galois Capital)

If you don't have an FTX account, you can use my referral link for a 10% discount: https://ftx.com/profile#a=1847531

If you want to access the ETHW, you can use a wallet that supports both networks or a centralized exchange. However, popular wallets like MetaMask will only support Ethereum PoS by default.

Thus, using a decentralized wallet to play the Merge is cumbersome. Therefore, you might like to opt for a centralized exchange.

So far, Justin Sun has led the launch of two new tokens on the Tron blockchain: ETHS and ETHW, representing Ethereum PoS and Ethereum PoW chains.

Current ETH holders can get 1 ETHS and 1 ETHW.

After the Merge, one can exchange these tokens 1:1 for ETHPoS and ETHW.

These tokens are traded on Poloniex and MEXC.

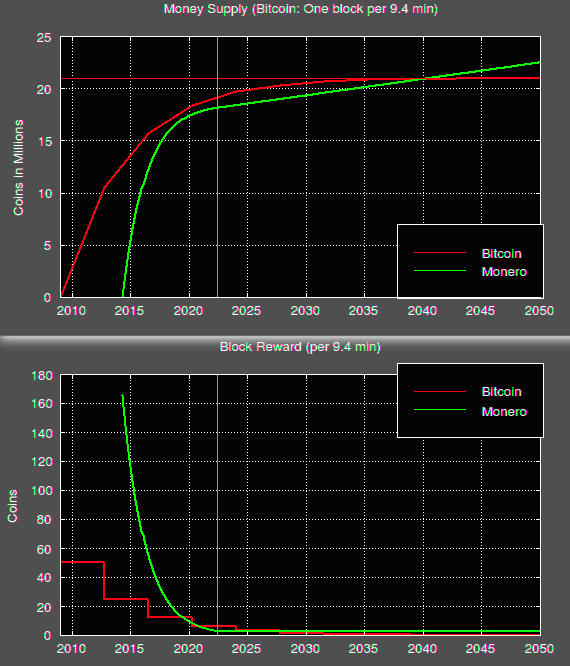

Monero POW

Numerous cryptocurrencies, including Monero and Bitcoin, employ the proof of work (POW) consensus algorithm. POW enables anybody with computing capacity to run nodes and mine cryptocurrencies.

That makes the network more decentralized than if just a small number of individuals could mine the cryptocurrency. However, as witnessed with Bitcoin and Ethereum mining, the mining process may become more centralized over time if certain individuals have more powerful computers than others.

Monero avoids this by continually altering its mining algorithm, rendering ASIC miners (specially constructed machines) useless. That implies that Monero can only be mined using CPUs and GPUs that are commonly available.

One advantage of a POW blockchain is that miners may ultimately outmine the holdings of huge investors (termed "whales"), who may control a major fraction of the cryptocurrency's total supply.

That would result in a gradual reduction of the whales' wealth and a more equitable distribution of currency.

Monero is one of the least ecologically friendly assets accessible due to its privacy characteristics, decentralized governance, and energy usage from cryptocurrency mining. Due to Monero's privacy characteristics, it is impossible to ascertain how many users it has or how evenly it is spread.

The circulating supply of XMR is approximately 18.16 million tokens, with an uncapped max supply. This means there is no theoretical limit to the number of XMR tokens that can be created, although the actual number in circulation is currently around 18 million.

This is because miners are incentivized in XMR to secure the network and receive rewards for doing so in the form of newly created XMR tokens.

In 2021, the emission rate per block was 1.26 XMR, resulting in 362406 XMR being mined last year. This made Monero an inflationary asset, as there was a net increase in the number of tokens in existence due to the mining rewards.

However, the emission rate has further decreased this year to 0.6 XMR per block, decreasing Monero’s inflation rate by ~39%. This change was made to reduce the inflationary pressure on the token and make it more attractive as a store of value.

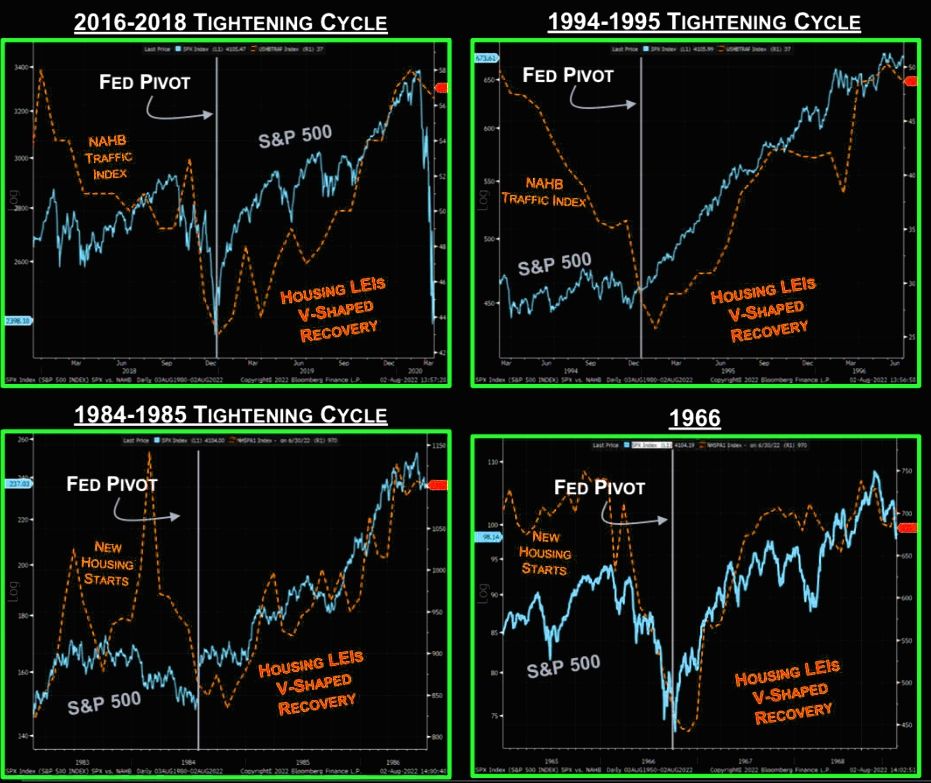

Federal Reserve (Fed) tightening cycle

In the past, there have been 4 times when the Federal Reserve (Fed) has tightened monetary policy, but this has not led to a recession. Instead, a new bull market has started.

However, Michael Kantro explains why this will not happen a 5th time. He states that food and energy inflation never rose above 5% in those previous cases. Additionally, housing prices quickly bottomed out as soon as the Fed stopped tightening.

However, the current economic conditions are not similar to those in the past, so a 5th time is not likely. The current economic conditions are different from the conditions in the past because food and energy prices have been rising at a faster pace than in the past.

Additionally, housing prices have not yet bottomed out, so the Fed stopping its policy of tightening could lead to further declines in the housing market.

These differences mean that it is unlikely that the Fed will be able to stop a recession from happening by tightening monetary policy again.

King dollar, the great short for 2023?

Forex is a relative game, meaning that the value of one currency is relative to another. The USD is considered the "king dollar", meaning it is generally seen as the most stable and reliable currency.

However, recent economic conditions have led to some speculation that the USD may not be as strong as it once was.

In particular, pricing for a US recession continues to decline, and the US 2/10 yield spread (the difference in yield between 2-year and 10-year Treasury bonds) has been printing new lows recently.

That indicates growing concern about the US economy, specifically the possibility of a recession in the coming 12 months.

The US 2/10 spread is the difference between the yields on two-year and 10-year US government bonds.

A lower US 2/10 spread indicates that the market is pricing in a potential US recession. That is because investors tend to buy more government bonds when they believe that a recession is coming (considered safe investments during times of economic uncertainty).

That, in turn, drives up the price of government bonds and pushes down the yield (the return on investment).

If the US 2/10 spread is at its lowest level in recent history, this could lead to a great short DXY setup. That is because if there is a US recession in the next 12 months, the US dollar will weaken relative to other currencies.

So, if you short the US dollar in 2023, you could make a lot of money if the US dollar does indeed weaken.

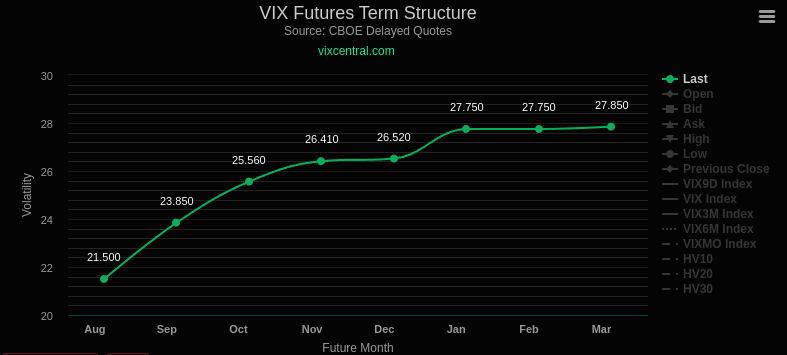

VIX

The VIX term structure defines the relationship between the pricing of various VIX options with various expiration dates. Typically, VIX options with shorter expiration dates are less costly than those with longer expiration dates since they have less time to expire and, hence, are less risky. However, due to the recent collapse of the VIX term structure, the converse is now true: VIX options with shorter expiration dates are now more costly than those with longer expiration dates.

This trend is being driven by the continuous decline of the VIX, which is now trading at all-time lows.

That has led many market participants to anticipate that the present era of low volatility would continue, reducing the likelihood that VIX options with longer expiration dates will expire "in-the-money." Consequently, they are ready to pay a higher premium for VIX options with shorter expiration dates.

Quants are probably discussing exploiting this opportunity's advantage by purchasing VIX options with shorter expiration dates and selling VIX options with longer expiration dates. This method is called a "volatility compression trade."

Goldman Sachs: Too early for the market to be trading a full Fed pivot

Goldman Sachs states that although some relief is expected from high inflation, it will not be enough for the Fed to stop hiking interest rates.

They forecast that the year-over-year core CPI inflation will be 6.1% in December of 2022 and that sequential price increases for core goods and services are expected to remain firm.

The analyst states that it will take until early next year for inflation to decline enough for the Fed to stop hiking.

Alexa, play suicidal thoughts by biggie.

For our "Technical analysts," a shooting star candle on the Nasdaq.

Is it time to think about unwinding? Take some risks off? Maybe this is the top of the bear market rally. We are about to find out in a few days.

More about bear market rallies? I have covered that in the previous post.

Still, I will copy-paste the text from my previous blog post.

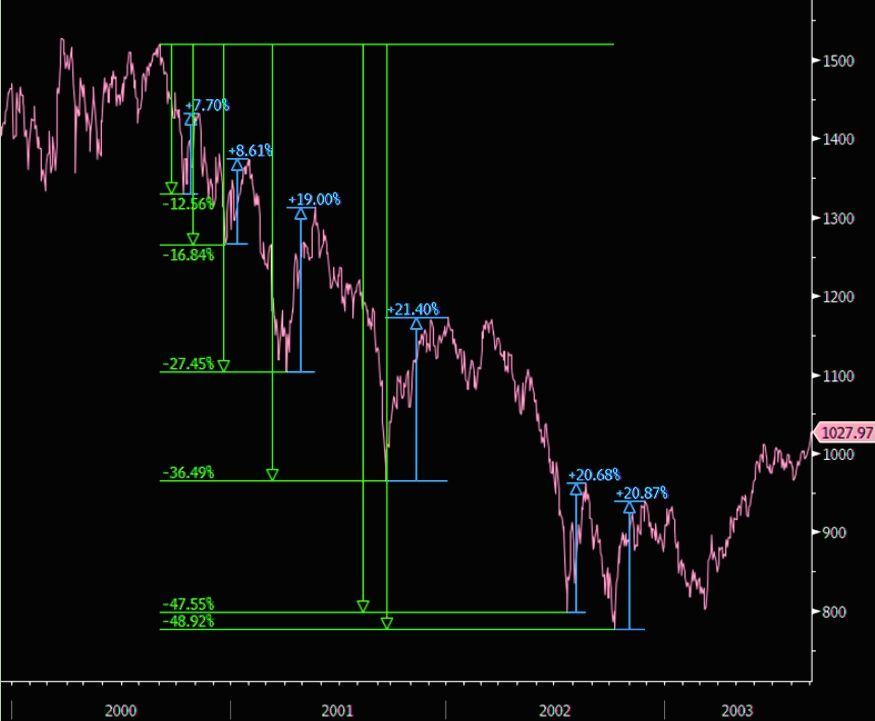

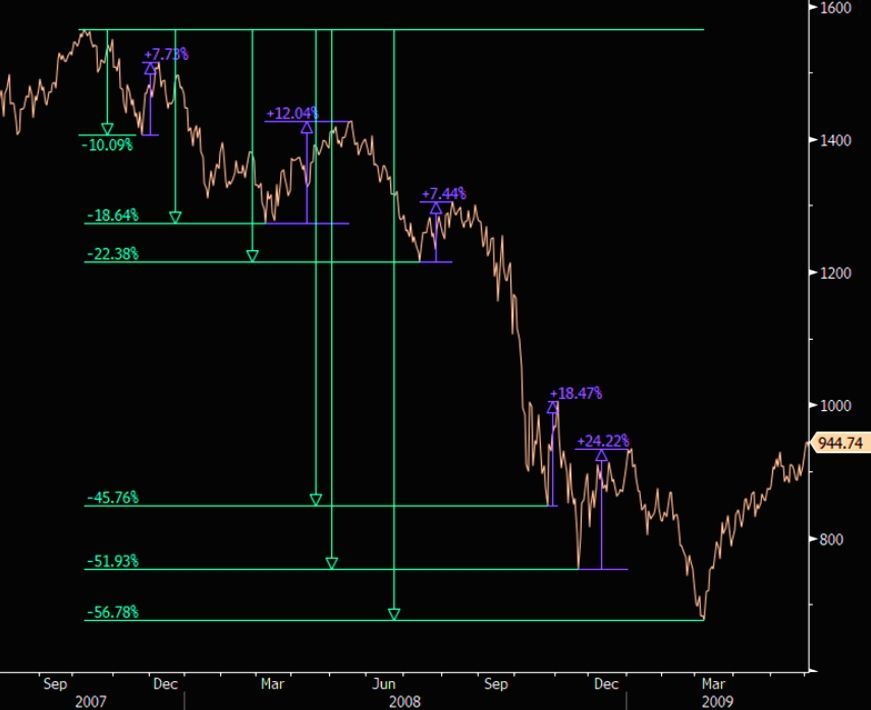

Bear market rallies

Bear market rallies tend to get bigger the more prolonged the bear market continues, so we could see a significant rally at some point.

However, it's important to remember that we are still in a bear market, and the magnitude of the fourth squeeze in bear markets between 2002 and 2008 was 21% and 19%, respectively.

Falling prices and pessimism characterize bear markets among investors. Nevertheless, even in a bear market, there will be periods of rising prices, known as bear market rallies.

Bear market rallies tend to become more remarkable as the bear market gets deeper and older. That is because as a bear market unfolds, investors grow more eager for any evidence of a recovery and are prepared to pay ever-increasing prices for assets they hope will return.

Eventually, the bear market will end, and prices will continue to climb continuously.

I posted this chart a few days ago.

Are we doing 2008 again?

It might be worth considering tail risk events. VIX is at lows, and markets are vulnerable right now. From hedging to "hedging only costs money bro"

It doesn't have to play out, but buy insurance when you can, not when the building is already on fire. VIXY, VIX calls, OTM puts?