Federal Reserve Possibly Opts for a Pause in Rate Hikes

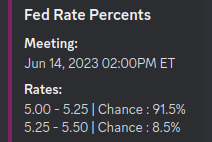

Despite speculation about potential pause or rate cuts in response to recent bank collapses, the Federal Reserve ultimately decided to proceed with a 25bps rate hike at their May 3 meeting.

They mentioned that they no longer saw the need for "additional policy tightening." That's a big change from what the markets anticipated.

Many argued that the Federal Reserve would continue to hike to control inflation. Now, however, it appears that there's a probability of a pause.

Discord invite

Are you already a premium member? Here's the invite link and instructions to join Discord

A quick rundown tightening cycle

The Federal Reserve tightening cycle refers to a series of interest rate hikes that the central banks implemented to combat inflation and attempt to maintain price stability.

The Federal Reserve raised its policy by a total of 5% since March 2022, when the inflation spiked to its highest level in 4 decades due to supply disruptions, labor shortages, and pent-up demand following the pandemic.

However, the Federal Reserve may signal a pause in its tightening cycle after the latest hike in May this month, which brought the policy rate range to 5-5.25%

Before continuing reading

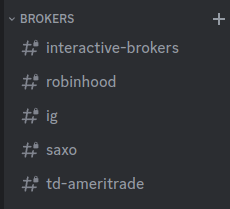

Do you feel like you're missing out due to only being able to trade crypto? Perhaps it's time to create a real broker account & join the big boys

I myself use Interactive Brokers: https://ibkr.com/referral/romano169

Feel free to sign up with other brokers & join us on Discord. The community members and I can help you with the registration process, questions, etc. You won't have to be alone

Reasons why the Federal Reserve might pause raising interest rates

- Recent data shows growth has slowed and inflation has moderated. The U.S. economy grew by an annualized rate of 2.7% in the first quarter of 2023, down from 4.1% in the previous quarter (according to the Bureau of Economic Analysis).

- The slowdown was partly due to the impact of higher interest rates on consumer spending, business investments, and the fading effects of fiscal stimulus. Inflation eased from its peak of 7.5% year-over-year in February 2023 to 6.1% in April (according to the Bureau of Labor Statistics).

- The Federal Reserve may expect inflation to fall further as supply & demand imbalances are resolved and as base effects from the last year's low prices fade.

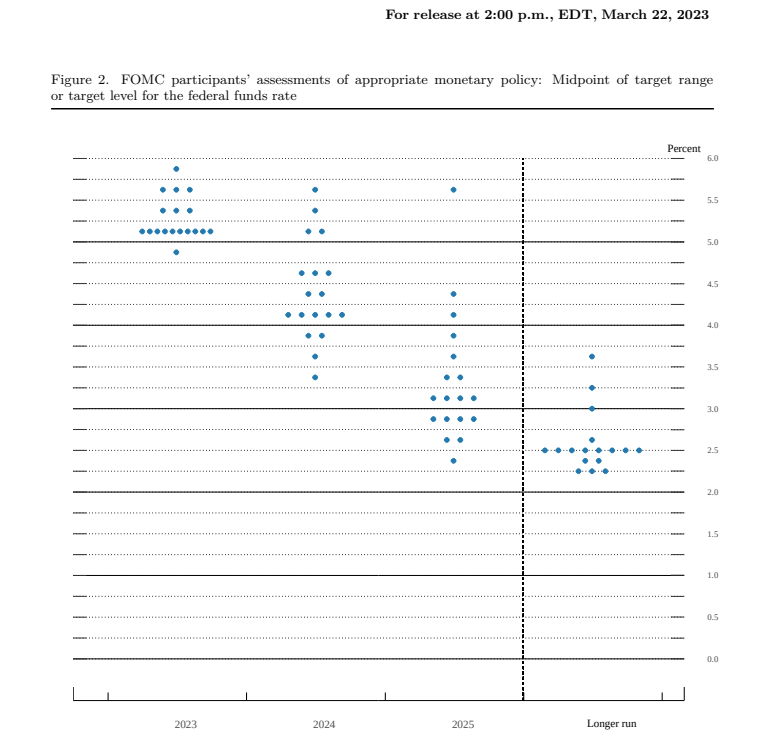

- Policy rates finally rose to levels consistent with the Federal Reserve guidance. The Fed's "dot plot", shows the projection of individual FOMC members for the appropriate level of policy rate over time, indicating that the median FOMC members expect the policy rate to be at 5.25% by the end of 2023.

- The stress in the banking system tightened financial conditions. The failure of 3 U.S. banks in late 2022 & early 2023 triggered a wave of credit tightening by other banks due to the exposure of risky loans, derivatives, and long-term bonds. The result of the credit tightening increased the cost of credit for households and businesses. The increased cost of credits resulted in reduced demand for loans and a dampening of economic activity.

- The Federal Reserve has provided liquidity support to the banking system through its discount window and other facilities. However, it may refrain from raising rates until they're confident that the financial system is "stable" and "resilient.

Source of information: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

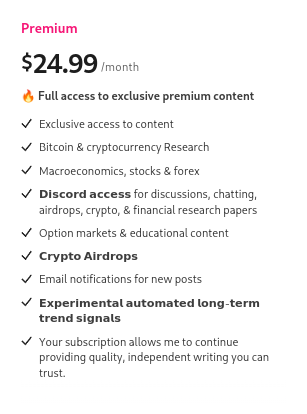

Before continuing reading, consider subscribing to the premium newsletter, which includes access to Discord Research room & discussion as added bonus.

Even if you don't trade, the airdrops shared in premium articles and Discord makes up for the subscription cost

Anyways you can continue to read further. The article does NOT stop here.

A pause

It's important to understand that a pause in rate hikes is not the same as a pivot. A "pause" means that the Federal Reserve will stop raising interest rates for a while and watch how the economy develops and how inflation levels evolve. The rate hikes have a "lag effect".

Now a pivot means that the Federal Reserve starts lowering interest rates.

A pause or pivot could affect different asset classes, such as bonds, equities, commodities, and currencies. Historically, when the Fed pauses, investors tend to move out of cash and into riskier assets that offer higher returns. "However, this time may be different", as uncertainty and volatility are high.

Before continuing to read this, ByBit is making KYC mandatory.

Consider ApeX DEX

Instructions:

https://twitter.com/RNR_0/status/1652360705331347461

Signup: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

Ref code: 46

Implications of a pause and rebalancing portfolio

Understanding how a "pause" in rate hikes could affect investment portfolios is important, especially if it happens.

In March, amidst the market volatility, several investors opted for cash alternatives like money market funds and ultra-short-term bond yields.

These low-risk solutions can provide attractive income but historical data shows that cash exposure typically returns less than core bond and short-term bond exposure when the Federal Reserve holds or drops interest rates.

The rest of the article is for premium members. Subscribe for a premium membership... 🖋